22 Tax Deductible Receipt Template

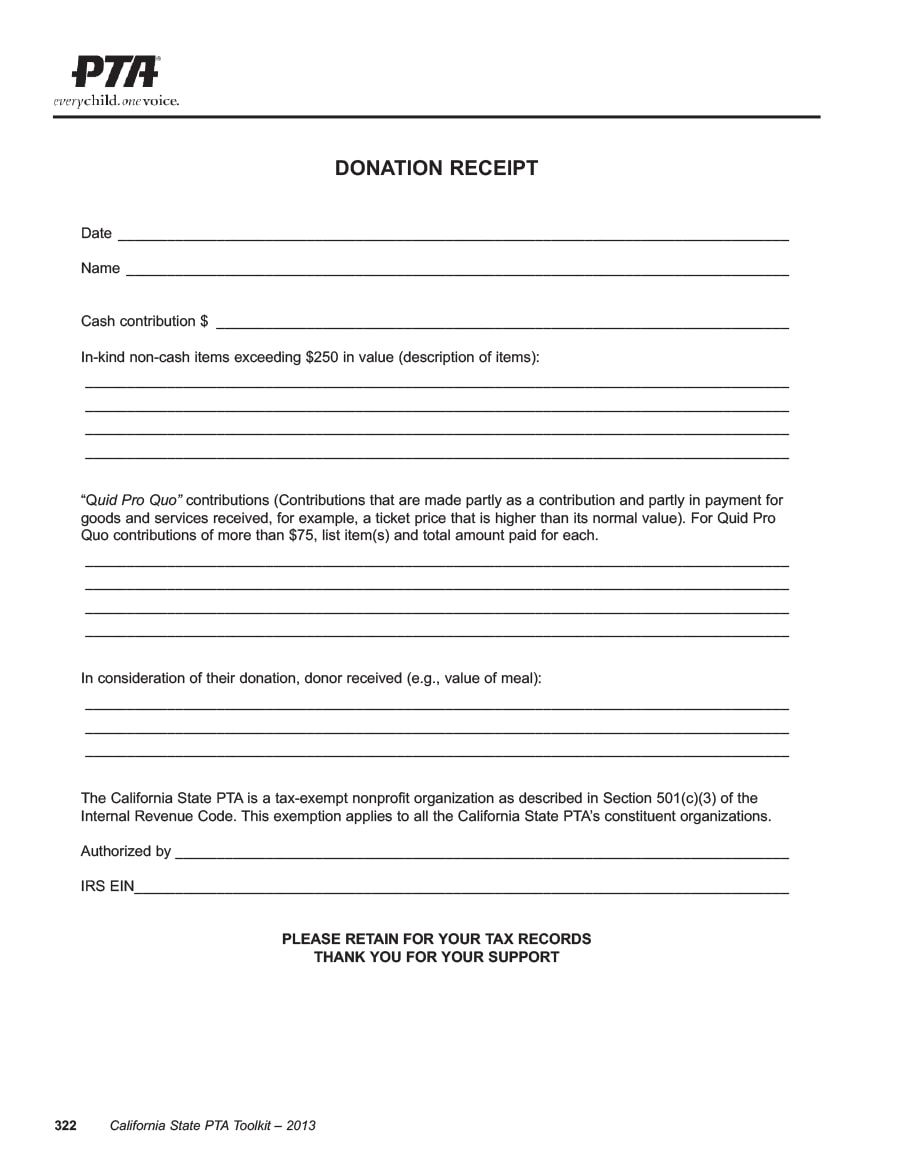

A note that the receipt is for a contribution made in return for a right to attend or participate in the fundraising event the amount of the contribution if the contribution is money the gst inclusive market value of the benefit received in return for the contribution that is the right to attend the event. From 1 jan 2011 all individuals and businesses are required to provide their identification number eg.

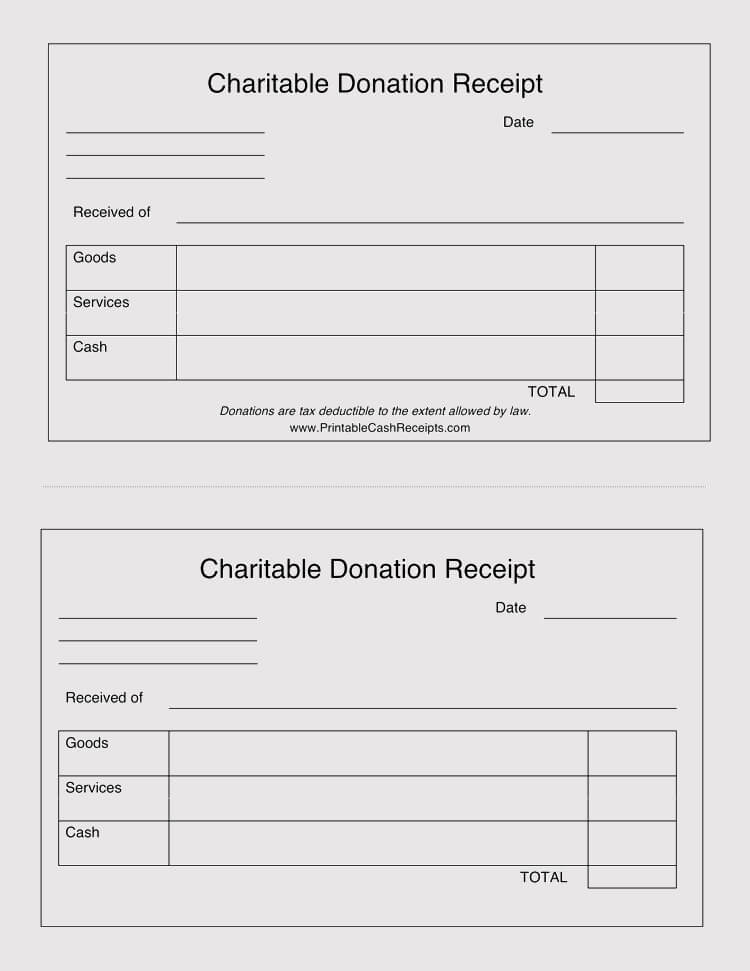

50 Free Receipt Templates Cash Sales Donation Taxi

50 Free Receipt Templates Cash Sales Donation Taxi

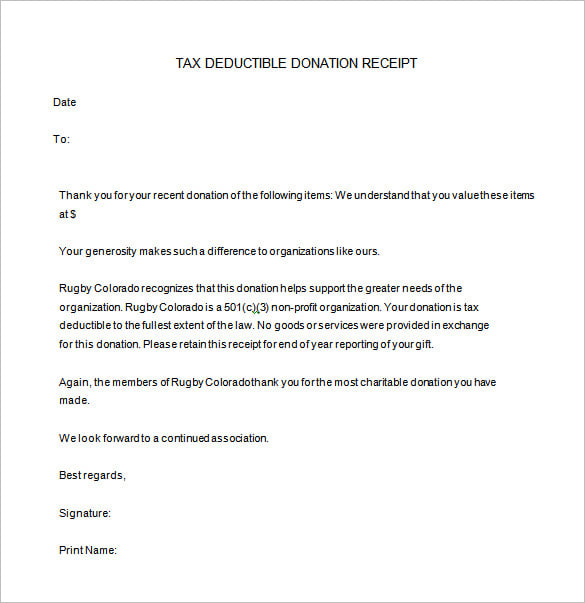

If the irs qualifies the organization receiving the donation as having tax exempt status the donation receipt is then used to claim a deduction on the donors income tax return.

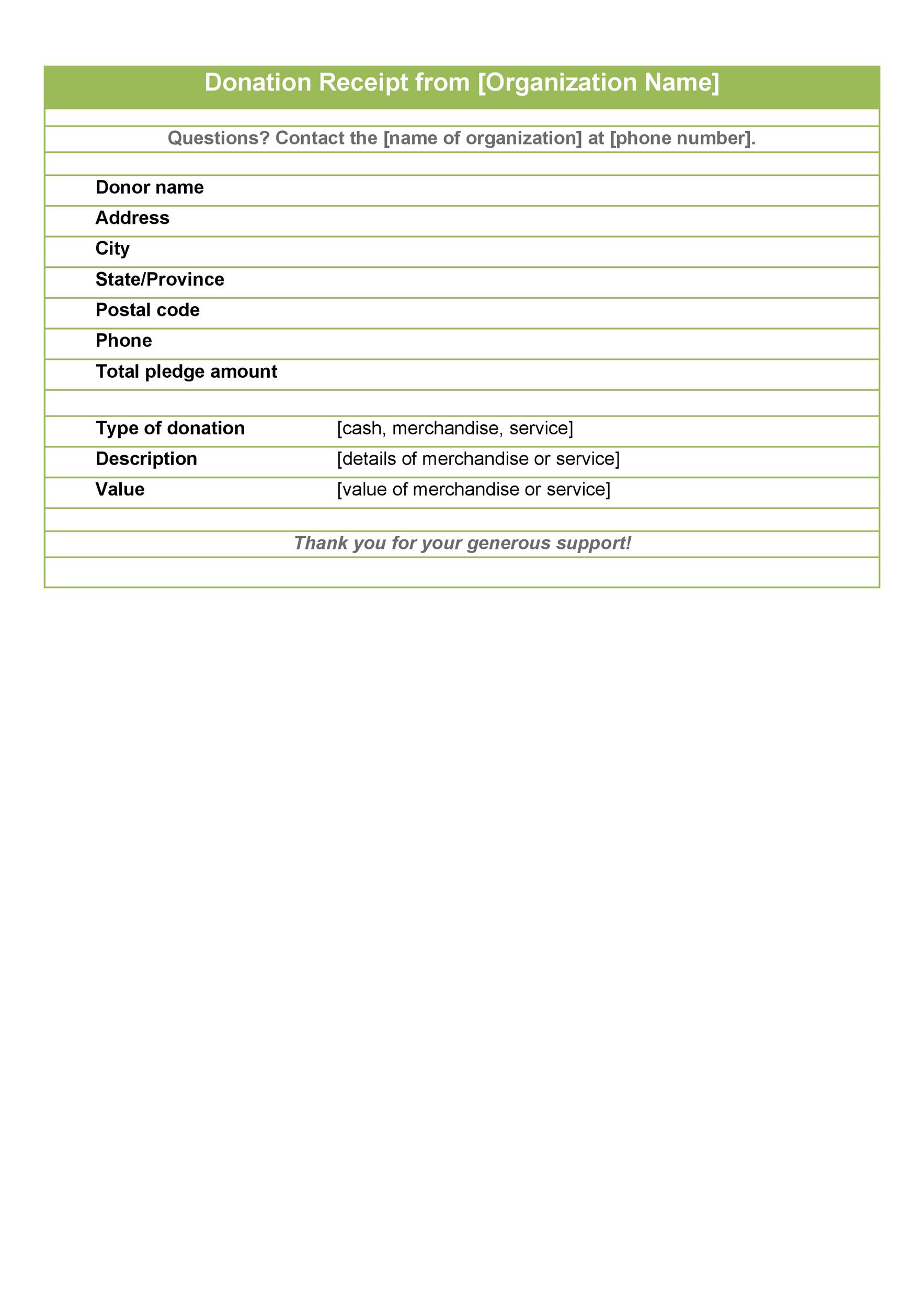

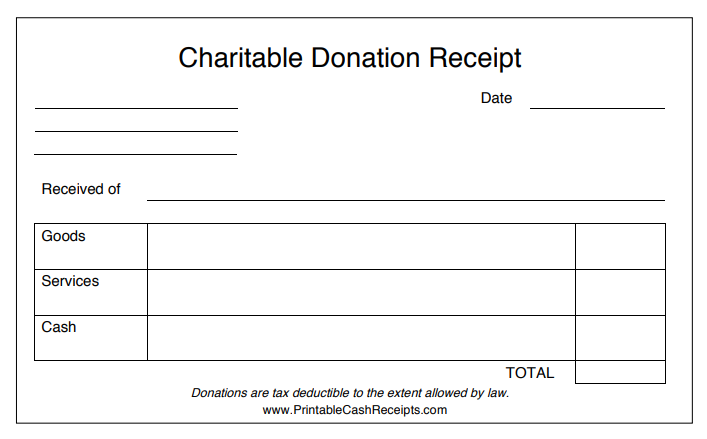

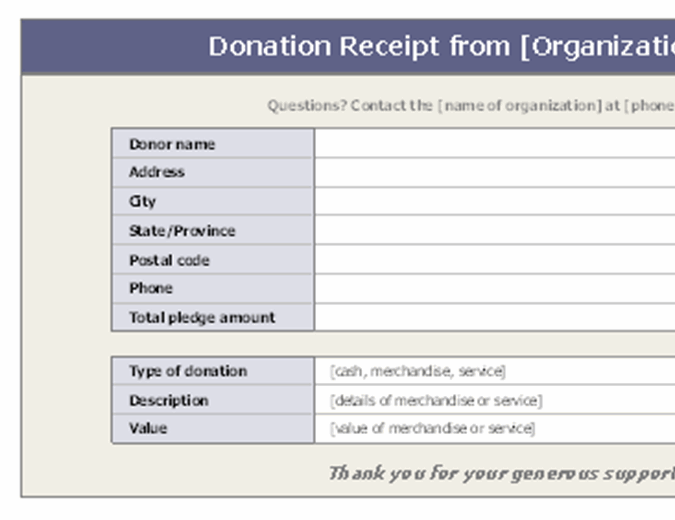

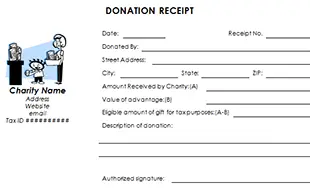

Tax deductible receipt template. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. A charitable tax receipt is used when giving out charitable donations. A tax deduction receipt should contain or incorporate the following with effect from 1 jan 2011.

Date when the receipt was issued and receipt number. This donation is tax deductible and the deduction will be automatically included in your tax assessment as you have provided your tax reference number eg. Donors information including name and address details.

Templates of tax deductible contribution receipts floyd green cpa pc is a georgia licensed cpa firm. The tax deductible donation receipt template provides basic information so that you only have to fill out the necessary information as follows. All donors who are looking for a solid charity to donate to should choose their charity with caution if youre looking for a deduction as you want to get the best return for your dollar as possible.

Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. This receipt is for your retention. Nricfinuen when making donations to the ipcs in order to be given tax deductions on the donations.

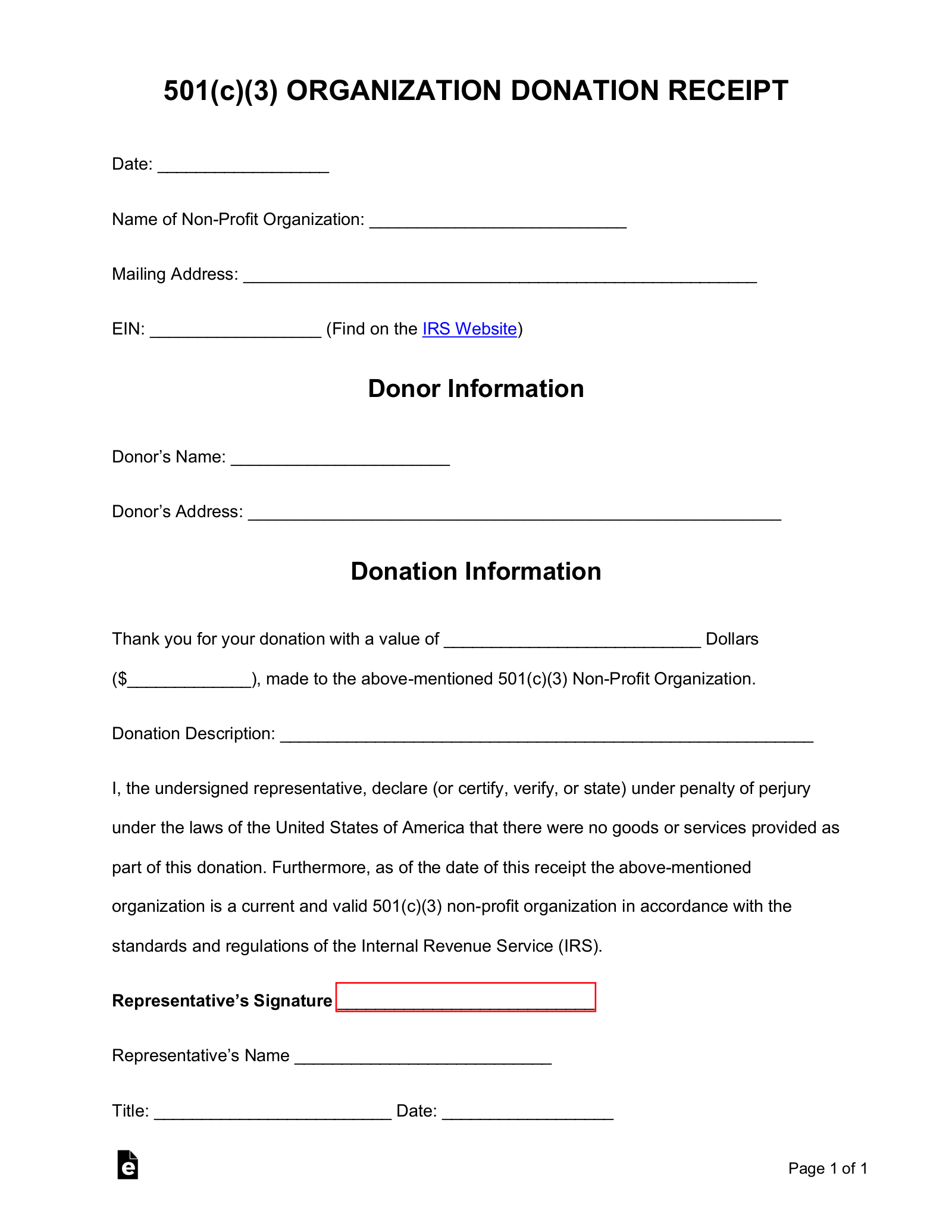

In business for over 8 years we have served over 2500 small businesses 501c3 organizations and individuals in all 50 states. Templates 501c3 tax deductible receipts pdf version 501c3 tax deductible receipts word version these are examples of tax donation receipts that a 501c3 organization should provide to its donors. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more.

According to experts there are various kinds of tax receipt. When donations are tax deductible the donation receipts issued by approved ipcs will indicate the words tax deductible. These include charitable tax receipts tax deductible donation receipts current tax receipts child care tax receipts among others.

The receipt shows that a charitable contribution was made to your organization by the individual or business.

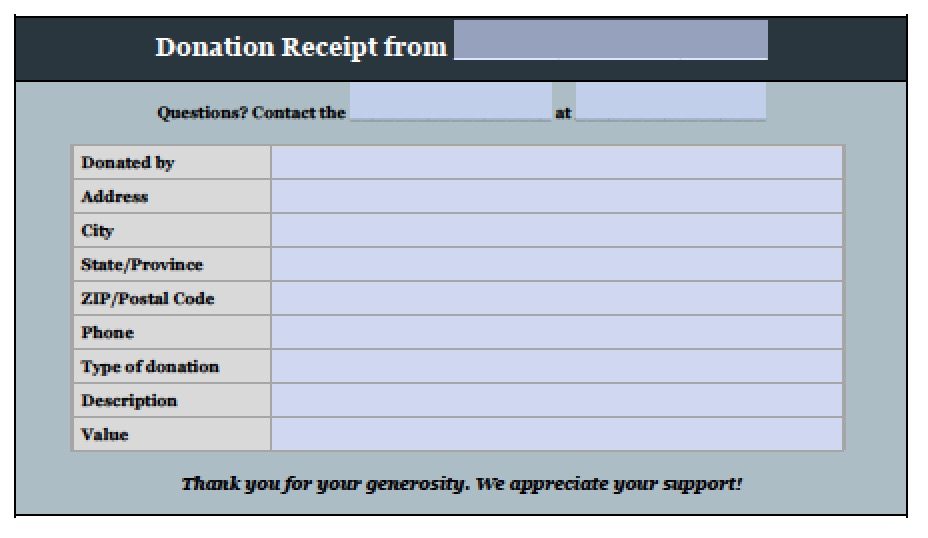

20 Free Donation Receipt Templates Amp Samples Free Fillable

20 Free Donation Receipt Templates Amp Samples Free Fillable

Tax Deductible Donation Receipt

Tax Deductible Donation Receipt

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

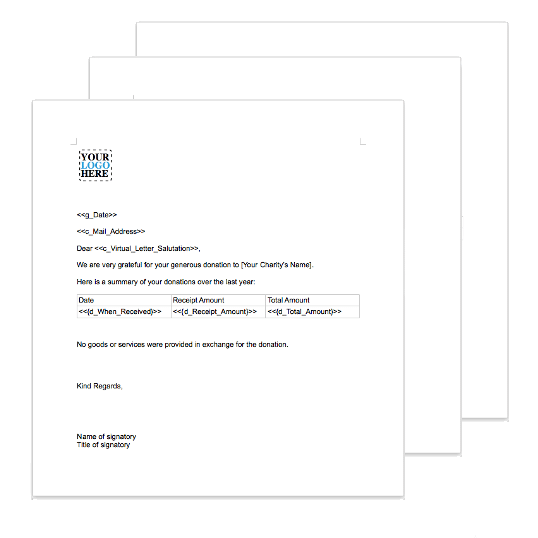

Donation Receipt Template For Excel

Donation Receipt Template For Excel

In Kind Personal Property Donation Receipt Template Eforms

In Kind Personal Property Donation Receipt Template Eforms

10 Donation Receipt Templates Doc Pdf Free Amp Premium

10 Donation Receipt Templates Doc Pdf Free Amp Premium

Free Printable Tax Receipt Template

Free Printable Tax Receipt Template

Clothing Donation Receipt Template Fill Online Printable

Clothing Donation Receipt Template Fill Online Printable

How To Create A 501 C 3 Tax Compliant Donation Receipt

How To Create A 501 C 3 Tax Compliant Donation Receipt

Free Donation Invoice Template Receipt Pdf Word Excel

Free Donation Invoice Template Receipt Pdf Word Excel

Donation Receipt Template Free

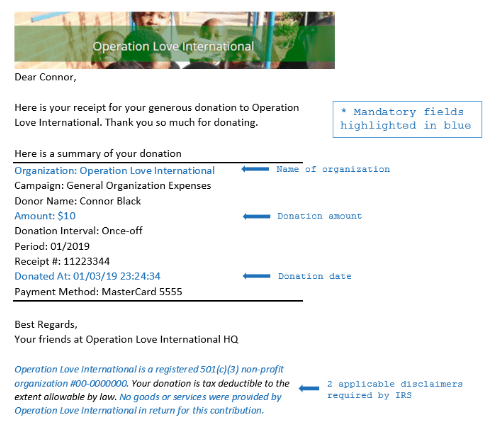

Sumac Nonprofit Donation Receipts

Sumac Nonprofit Donation Receipts

Everything You Need To Know About Donation Receipts

Everything You Need To Know About Donation Receipts

Free 501 C 3 Donation Receipt Template Sample Pdf

Free 501 C 3 Donation Receipt Template Sample Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Free Non Profit Donation Receipt Template Vincegray2014

Free Non Profit Donation Receipt Template Vincegray2014

Donation Receipt Template Free Receipt Templates

Donation Receipt Template Free Receipt Templates

0 Response to "22 Tax Deductible Receipt Template"

Post a Comment