21 Tax Donation Receipt Template

Charitable donations without a receipt. Free donation receipt templates word pdf when accepting donations there are various requirements that your organization needs to meet in order to be compliant with the rules of your area.

Nricfinuen when making donations to the ipcs in order to be given tax deductions on the donations.

Tax donation receipt template. In order to be able to make your own donation receipt template youd have to know what exactly should be included in it. A donation receipt template is customized as an email. This is essential for the donor to deduct tax based on the donation made to an organization.

The receipt template is a microsoft word document so that you can customize it and make it work for your organization. When you make a charitable donation its your responsibility to make sure to obtain the donation receipt or you may not receive one. When donations are tax deductible the donation receipts issued by approved ipcs will indicate the words tax deductible.

If it is your first time creating a tax donation receipt letter we can understand your apprehensions well. A charitable tax receipt is used when giving out charitable donations. One requirement is that you give donors a donation receipt also known as a 501 c 3.

Also have a look at our editable receipt sample templates to make such documents easily. Any single instance where a donation is made up to 250 does not need a receipt. From 1 jan 2011 all individuals and businesses are required to provide their identification number eg.

This can also be produced as a letter. When writing this specific type of receipt you need to pay close attention to essential information such as the date of donation the amount donated in cash description of goods donated receivers name and address and signature. This could be in the form of a signature.

If you are managing a charity organization you must deal with creating tax deductible donation receipts on a regular basis. An acknowledgment by the charity is also essential to label it as a valid donation. The name of the group organization or association along with its federal tin and a short notice which states that the group organization or association is registered.

Donation receipts are quite simply the act for providing a donor with a receipt for their monetary contribution to an organization such as a charity or foundation. The date the donation was made. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible.

Sample donation receipt template. Under this rule a person may make ten 10 trips to donate clothes and claim it as a tax deduction without proof or a receipt. Printable donation receipt letter.

However we are sure that an example of the same will help you create one with ease. We provide you with a tax deductible donation receipt template to help you create tax deductible donation receipts quickly and easily. Once the amount for any donation reaches 250 or more a receipt is required.

501 c 3 donation receipt templates.

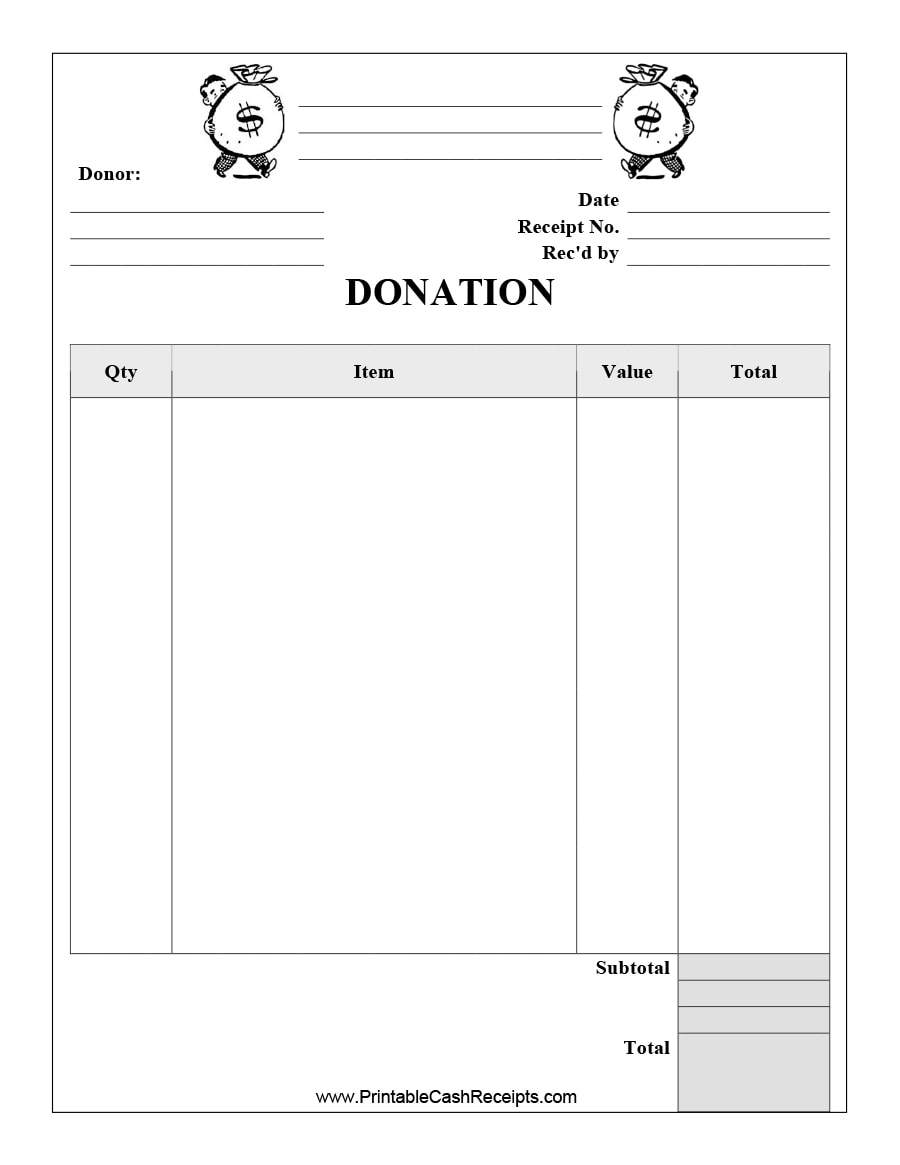

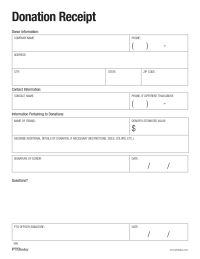

Free Printable Donation Receipt Template

Free Printable Donation Receipt Template

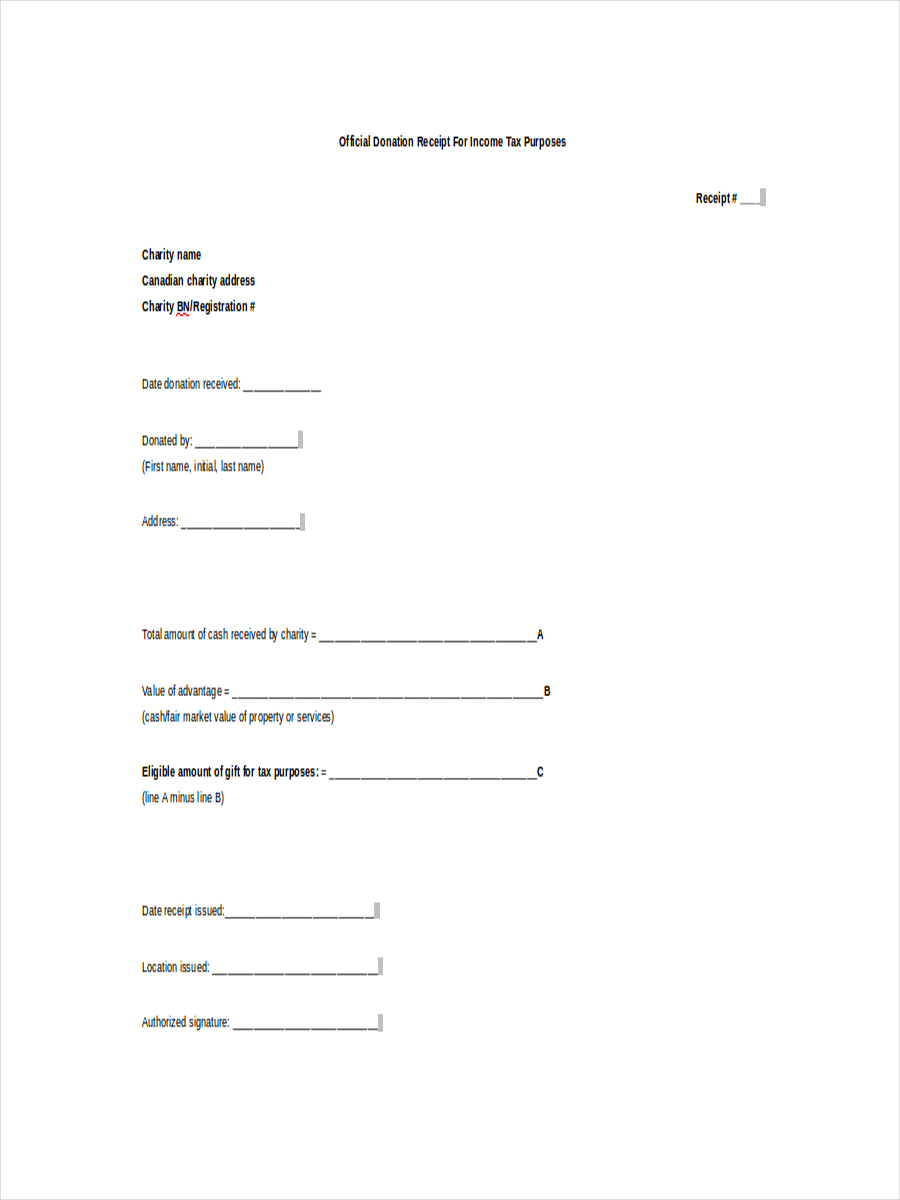

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

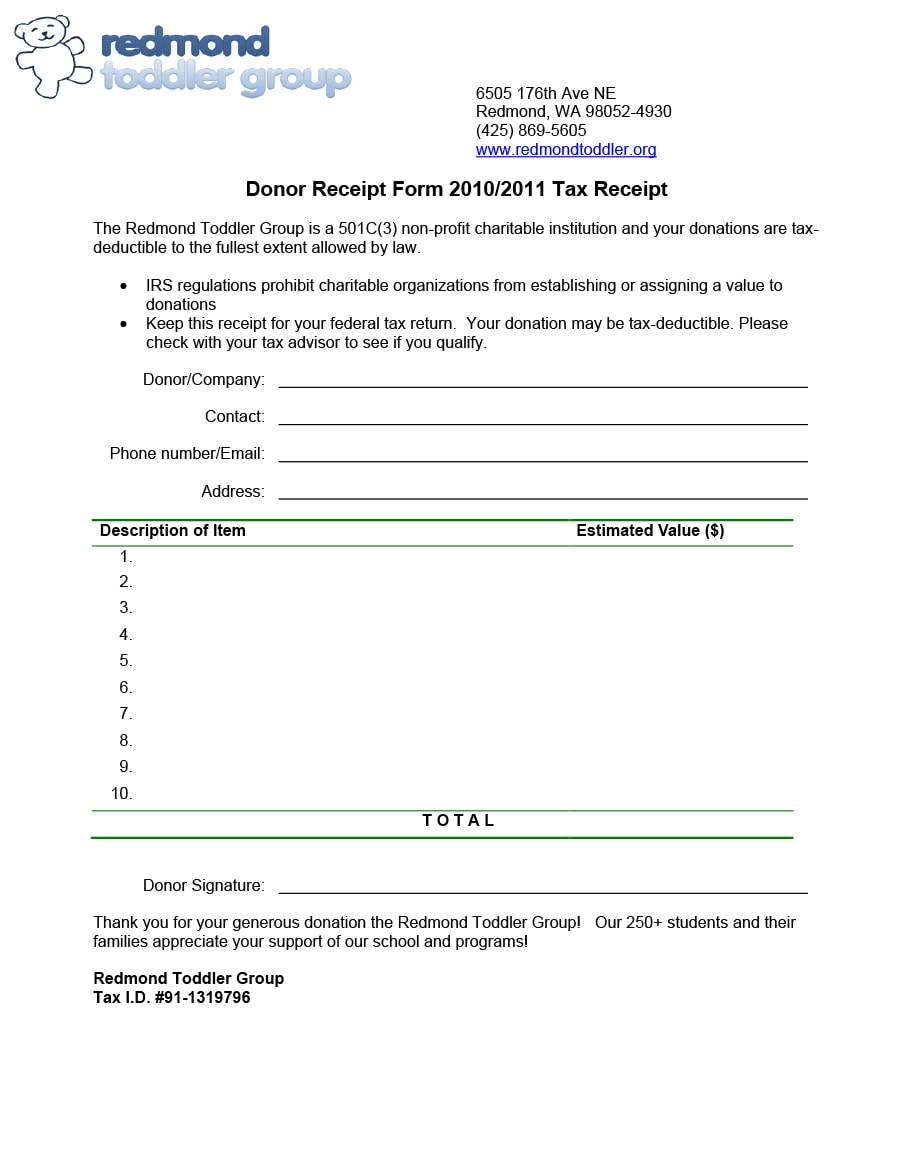

Non Profit Donation Receipt Template Using The Donation

Non Profit Donation Receipt Template Using The Donation

Donation Gift Receipt Quid Pro Quo Small Business Free Forms

Donation Gift Receipt Quid Pro Quo Small Business Free Forms

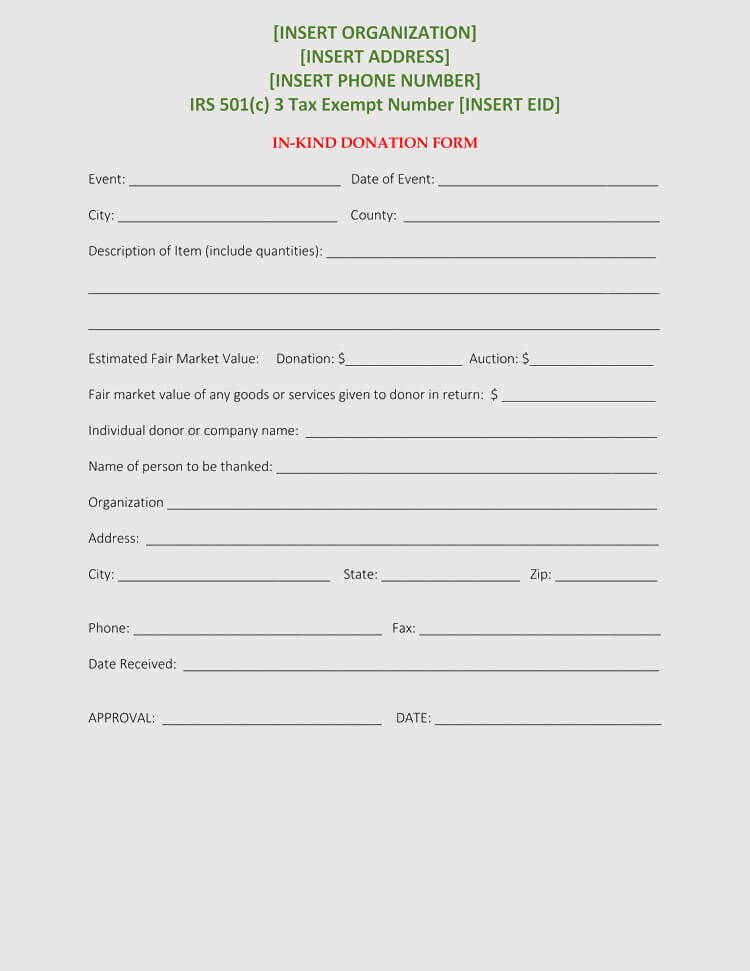

50 Free Donation Receipt Templates Word Pdf

50 Free Donation Receipt Templates Word Pdf

2013 2020 Form Ca Pta Toolkit Fill Online Printable

2013 2020 Form Ca Pta Toolkit Fill Online Printable

Donation Receipt Template Free

How To Create A Donation Receipt 13 Steps With Pictures

How To Create A Donation Receipt 13 Steps With Pictures

55 Donation Receipt Templates Amp Letters Word Pdf Excelshe

55 Donation Receipt Templates Amp Letters Word Pdf Excelshe

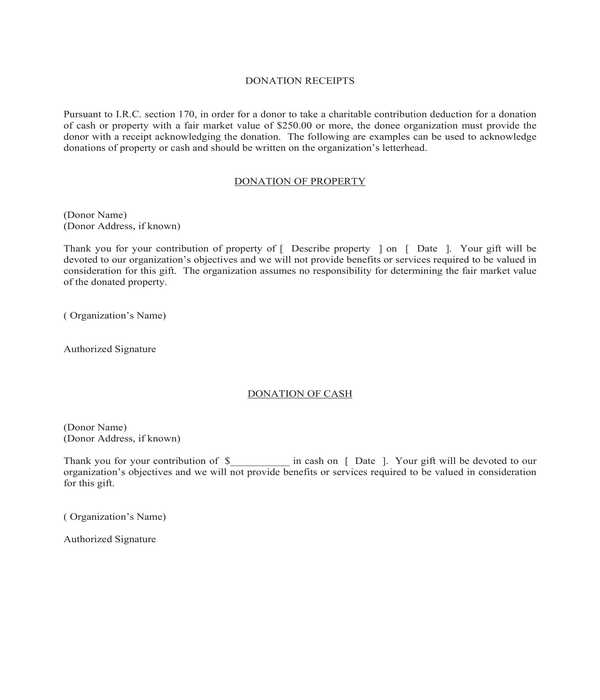

Free 8 Tax Receipt Examples Amp Samples In Pdf Doc Examples

Free 8 Tax Receipt Examples Amp Samples In Pdf Doc Examples

How To Create A Tax Compliant Receipt For Donors Of A 501 C

How To Create A Tax Compliant Receipt For Donors Of A 501 C

Why It Is Vital To Have A Donation Receipt Letter For Tax

Why It Is Vital To Have A Donation Receipt Letter For Tax

45 Free Donation Receipt Templates Non Profit Word Pdf

45 Free Donation Receipt Templates Non Profit Word Pdf

Pto Today Nonprofit Donation Receipt Pto Today

Pto Today Nonprofit Donation Receipt Pto Today

Create Donation Tax Receipts From Salesforce Formstack

Create Donation Tax Receipts From Salesforce Formstack

37 Donation Receipt Template Download Doc Pdf

37 Donation Receipt Template Download Doc Pdf

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

40 Donation Receipt Templates Amp Letters Goodwill Non Profit

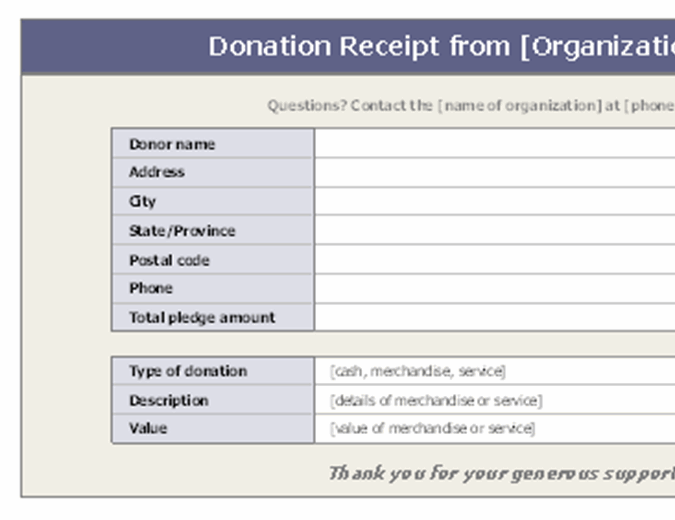

Free 5 Donation Receipt Forms In Pdf Ms Word

Free 5 Donation Receipt Forms In Pdf Ms Word

0 Response to "21 Tax Donation Receipt Template"

Post a Comment